Live Competitive Intelligence for Semiconductors, EV/ADAS & AI Apps

See every critical move in your stack—curated, tagged, searchable—then connect those signals to analyst-grade reports when you need the full story.

How Innovista V3 Works

Three core principles that make Innovista the intelligence edge for high-tech leaders

Live Radar, Not Static Research

- •100+ signals per month, curated and tagged by sector, entity, theme, severity

- •Dashboards show "what's moving now" in pricing, capacity, alliances, and demand

- •Real-time updates when markets move—not quarterly reports

Vertical-Deep, Not Generalist

- •Only 3 ecosystems: Semiconductors, EV/ADAS, AI Apps

- •Feeds tuned for HBM, chiplets, CoWoS/EMIB, EV incentives, ADAS SoCs—not generic "tech trends"

- •Domain depth beats breadth for strategic decisions

Market Memory You Can Search

- •Every signal stored, tagged, and searchable (entity, theme, sector)

- •Build timelines of memory pricing, AI server BOM, EV demand—not one-off newsletters

- •Your competitive intelligence library grows with every signal

Core CI Products

Seven integrated intelligence tools—from real-time signals to deep-dive reports and custom enterprise support

CI Radar & Sector Views

Your new crown jewel: See every critical move in your stack in one place—no more digging through feeds.

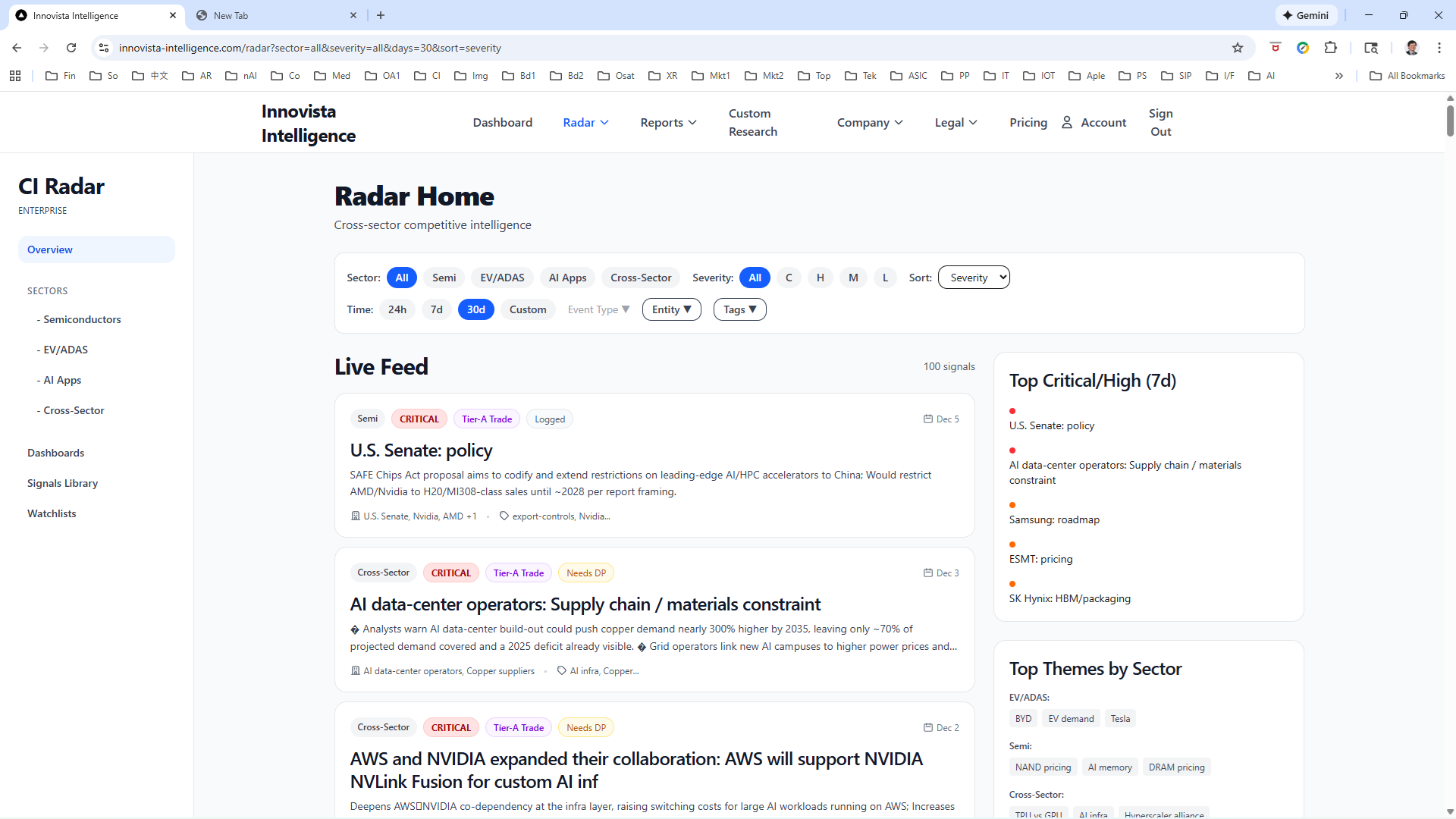

Radar Home

- • Cross-sector view: Semi, EV/ADAS, AI Apps, Cross-Sector

- • Top critical signals (7d)

- • Top themes by sector

- • Top movers (entities with most signals)

Sector Radars

- • Sorted feed of signals (by severity / date / entity)

- • Critical Queue (7d) for each sector

- • Top Themes (HBM4, AI server BOM, US EV demand, CoWoS vs EMIB)

- • Top Entities (TSMC, Samsung, NVIDIA with counts & C/H ratio)

Dashboards (Pulse + Trend View)

In 60 seconds, see if your world is heating up or cooling down.

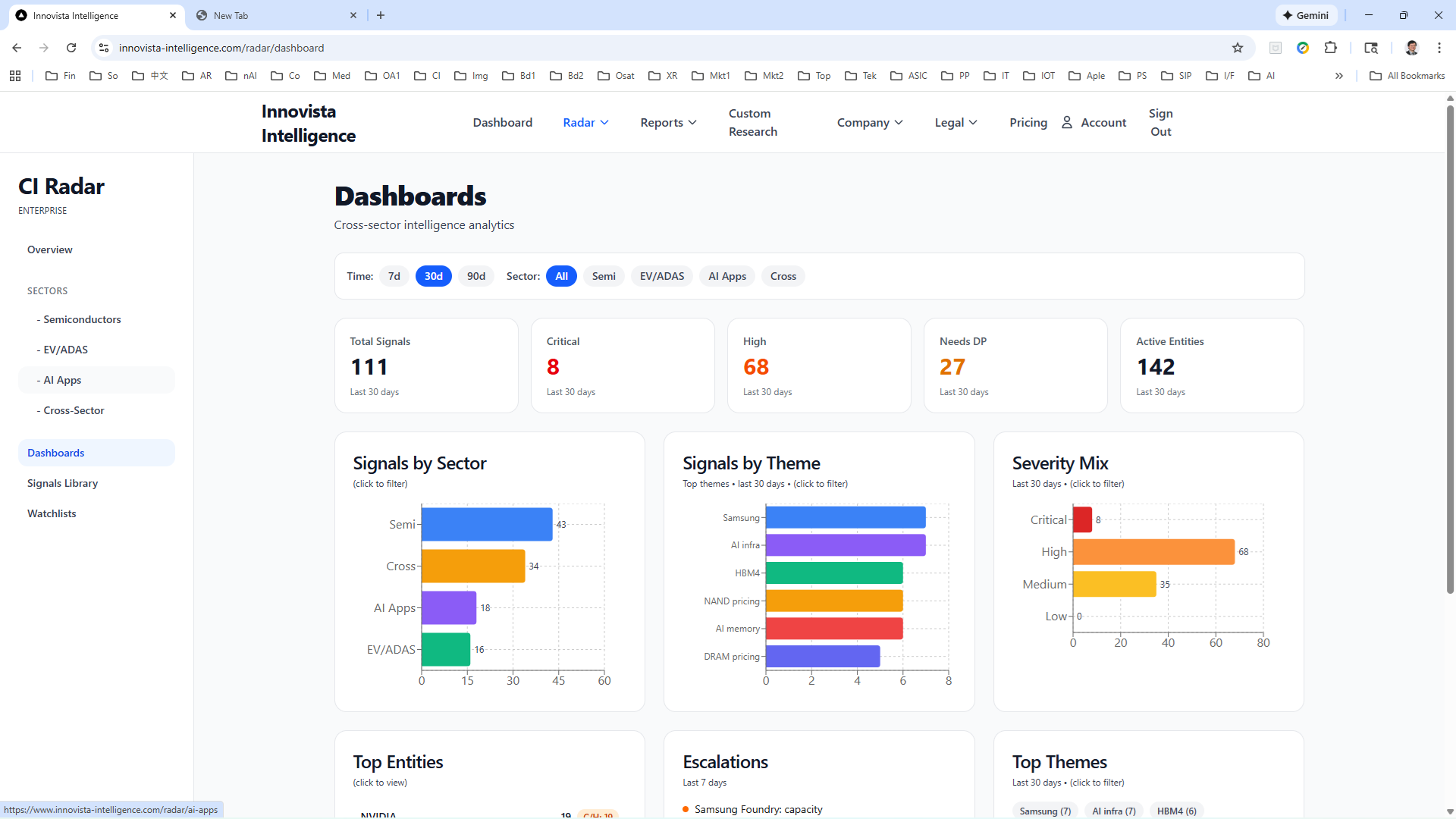

What You Get

- • Signals by Sector, Theme, Severity (last 30/90 days)

- • Escalations (7d)—things keeping you up at night

- • Emerging Themes—tags gaining momentum

- • Top Entities—who's driving the narrative (NVIDIA, Samsung, Tesla)

Dashboard Value

Corporate strategy teams use dashboards for weekly pulse checks before executive briefings. See momentum shifts in HBM pricing, AI server demand, or EV incentive policies at a glance.

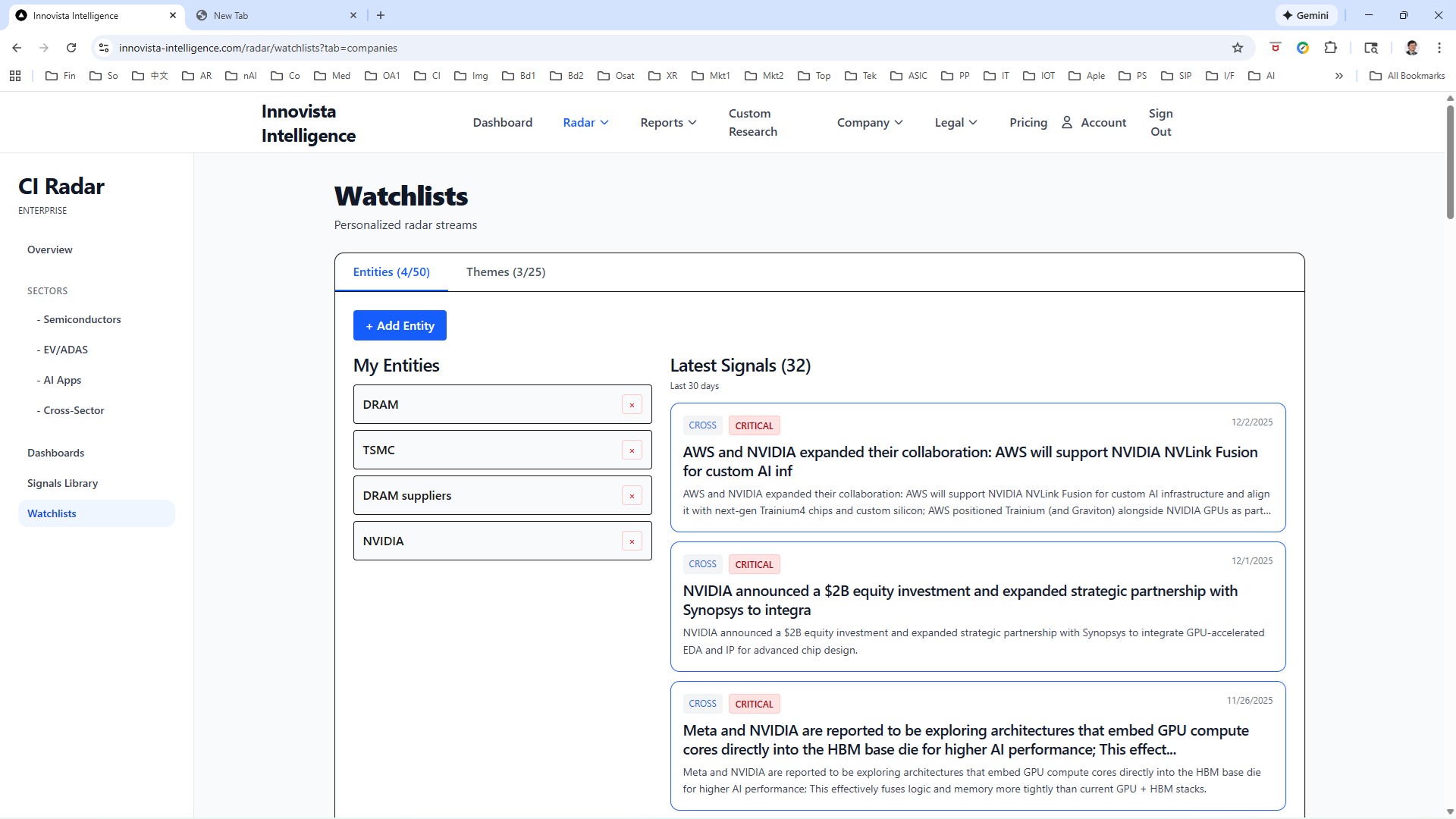

Watchlists (Personalized Radar)

Configure your own radar streams around customers, suppliers, or themes—without touching the data plumbing.

Watchlists (Entities)

Follow DRAM suppliers, CXMT, Tesla, BYD, or NVIDIA's ecosystem, and get a custom feed of just those signals.

Example: Track Samsung, SK Hynix, Micron for HBM competitive moves

Watchlists (Themes)

Track topics like "CoWoS vs EMIB", "AI memory", "US EV demand" across all sectors.

Example: Monitor "Advanced Packaging" to see CoWoS, EMIB, and SiP developments

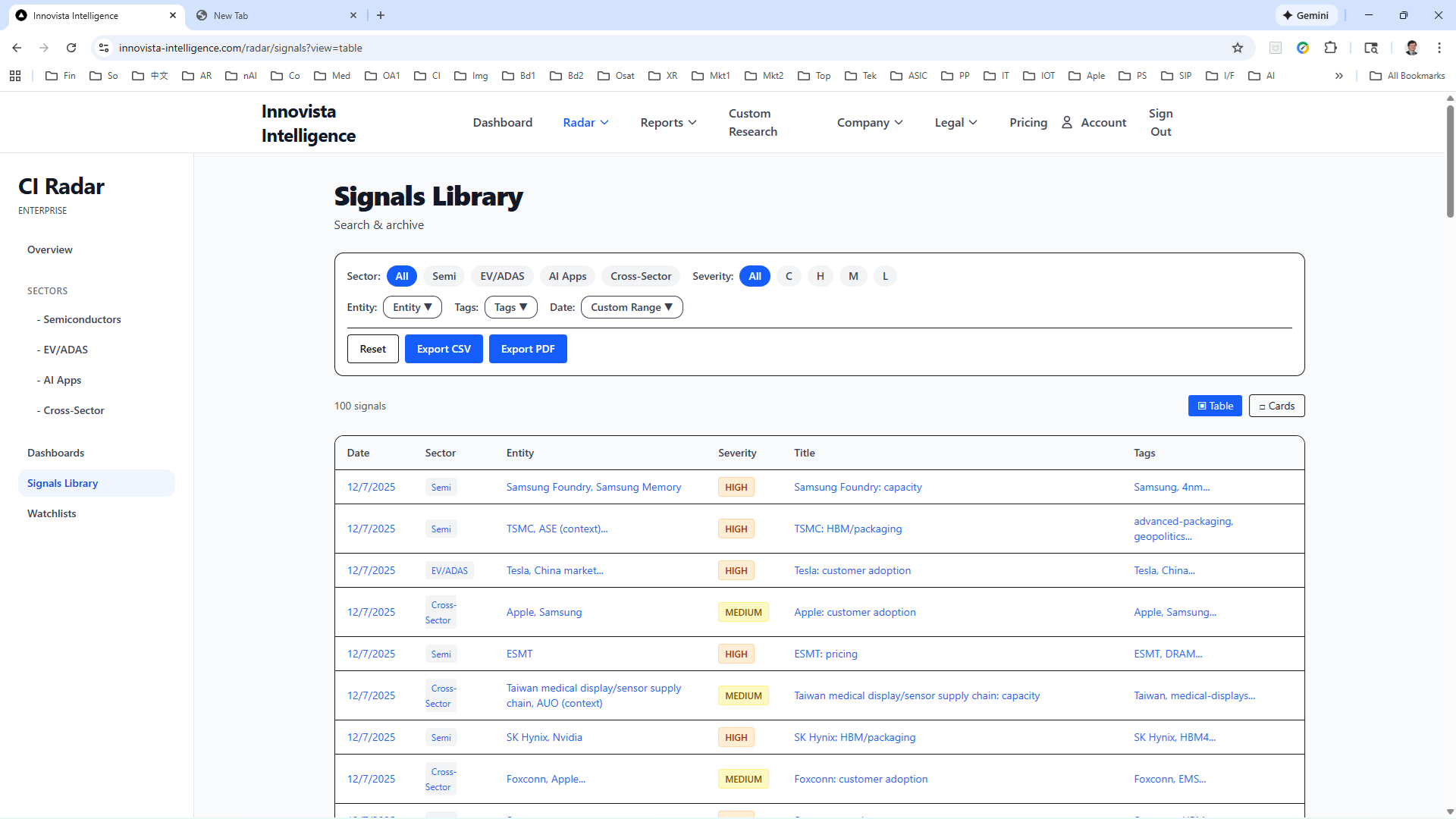

Signals Library (Search + Export)

Every signal you've ever seen, searchable in seconds—not lost in Slack or email.

Key Capabilities

- • Filter by: sector, entity, severity, theme, date, status

- • Full-text search across all signals

- • Export to CSV/PDF for internal briefings

- • Use for investor decks and quarterly risk reviews

Search Power

Sales teams export signals on customer companies before account reviews. Strategy teams build timeline analyses of HBM pricing or EV demand patterns over 90 days.

Monthly CI Reports — The Pulse

Short, visual monthly intelligence briefs that track the most important moves across Semiconductors, AI & Applications, and Automotive (EV/ADAS).

What It Is

Built from structured CI signals, earnings, and trusted sources—filtered so you only see what actually matters.

Who It's For

- • CI / strategy teams that need a continuous feed of validated signals

- • Product, marketing, and sales that want early warning on demand shifts & competitor moves

- • Execs who prefer a 10–15 minute monthly scan over daily news-chasing

What You Get

- • Charts and short commentary on pricing, capex, utilization, design wins, policy shifts

- • Segment-specific highlights for Semis, AI, and EV/ADAS

- • A format designed to be skimmed quickly and referenced all month

QTL Reports – The Map (Quarterly Technology Landscape)

Deep, structured quarterly briefings on specific technology landscapes. Where Monthly CI tells you what just moved, QTL tells you how the whole segment is evolving.

What It Is

Deep, structured quarterly briefings on specific technology landscapes—like advanced memory, RF & 5G, power semis, RISC-V ecosystem, EV/ADAS electronics, and more.

Who It's For

- • Executives and BU leaders who need a clear quarterly view of their segment

- • Strategy / CI / Corp Dev building roadmaps, partnership theses, and board updates

- • Product and marketing teams aligning launches and positioning to real market structure

What You Get

- • "What changed this quarter?" executive summary

- • Market structure, key segments, and regional mix

- • Competitive landscape and scorecards

- • Technology and roadmap updates

- • Supply chain, capex, and risk signals

- • SWOT and 3–5 year scenario outlooks

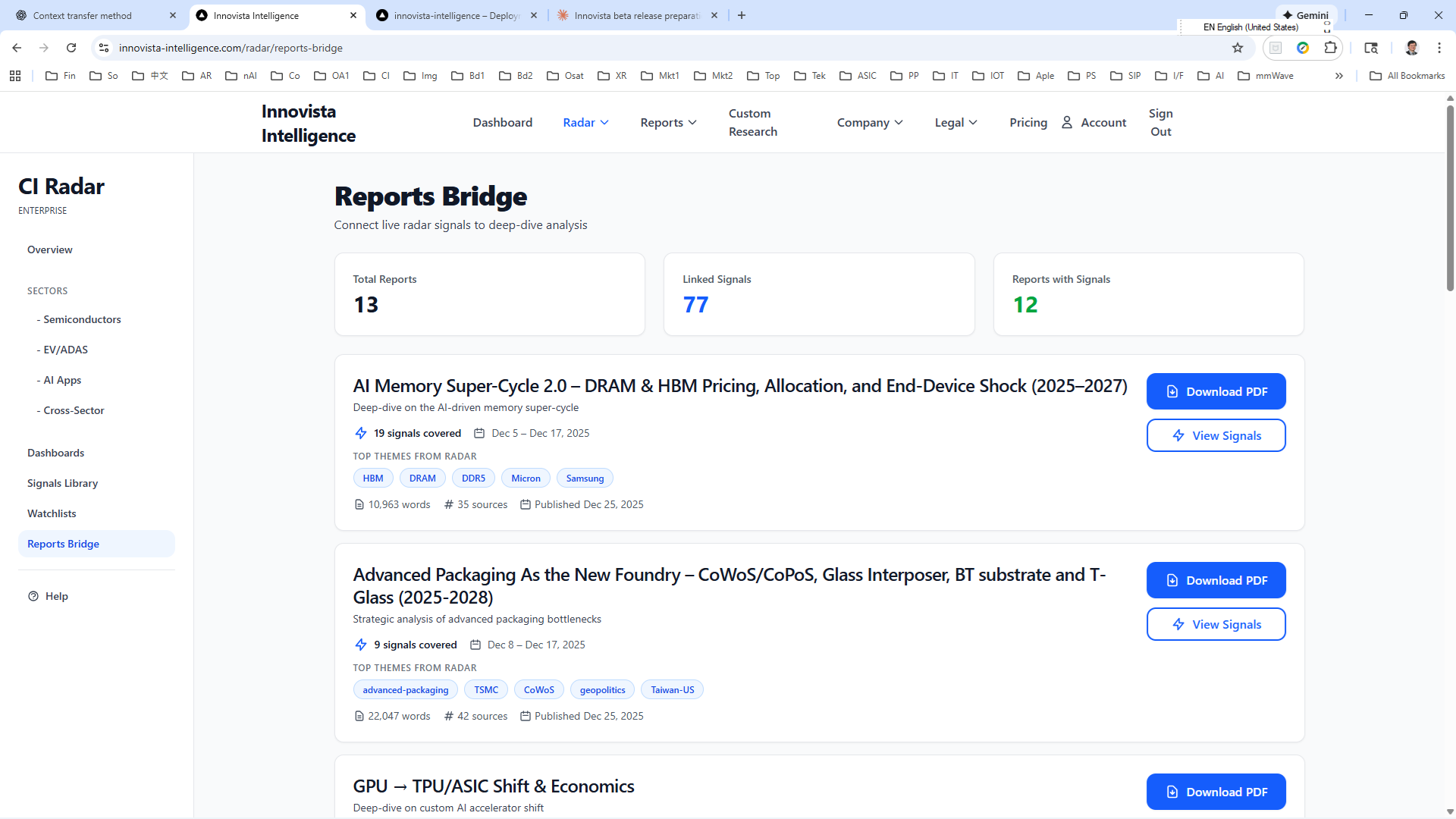

Deep Dive Reports Bridge — The Playbook

Single-topic, analyst-grade deep dives on the most important themes surfaced by your Radar. Instead of covering everything, a Deep Dive stays on one topic and pushes it all the way to "so what do we do?"

What It Is

Single-topic, analyst-grade deep dives on themes like: AI Memory Super-Cycle 2.0, HBM4 vendor race, GPU → TPU/ASIC shift, China EV overcapacity, Smart cockpit & ADAS value migration.

Who It's For

- • C-suite & GMs making investment and strategic bets

- • Strategy / CI / Corp Dev teams building theses and board narratives

- • Product, BD, and sales leadership adjusting roadmaps, pricing, and key accounts

- • Investors & advisors tracking high-impact structural shifts

What You Get

- • A focused narrative built from your CI signals plus external research

- • Clean fact base: economics, capacity, competition, policy, and risk drivers

- • 3–4 structured scenarios with timing and leading indicators

- • Clear strategic implications and recommendations by stakeholder type

- • Embedded citations so your team can drill back to sources

Where Innovista Wins vs. Competitors

Six competitive edges that make Innovista the choice for high-tech intelligence

1. Vertical Focus

They cover everything; we cover 3 tightly defined ecosystems in crazy depth.

Our feeds & tags are tuned to CoWoS, HBM, CSP capex, EV demand, ADAS stacks—not generic "AI" chatter.

2. Signal-First, Not Document-First

They throw millions of docs at you with search. We give ranked, curated signals with severity, "what changed / why it matters," and dashboards.

High signal-to-noise ratio for busy strategists.

3. Always-On, Real-Time Competitive Sensing

Continuous monitoring with alerts on meaningful changes (pricing, capacity, supply chain moves, etc).

Selling warning more than "big reports".

4. Pricing + Accessibility

Entry tier that a senior PM or BD lead can put on a corporate card.

Multi-seat Pro/Enterprise undercuts enterprise CI tools but still looks premium.

5. Hybrid AI + Human Curation

We use AI to triage feeds but human judgment for what becomes a signal.

Talk about "noise reduction" and "high signal-to-noise ratio."

6. Founder-Led Expertise

Our team have vast semi / EV / AI domain background.

Built by semiconductor and AI industry insiders, not generic market researchers.

Ready to Experience V3?

See how corporate strategists, product leaders, and investors use Innovista's live intelligence radar to stay ahead of the market.